资 讯

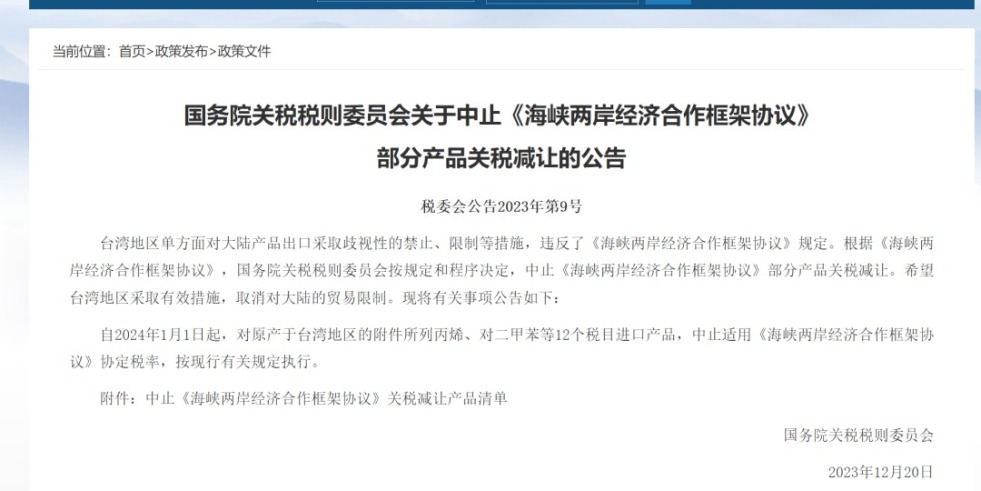

中止《海峡两岸经济合作框架协议》 部分产品关税减让对原产于台湾地区的丙烯、对二甲苯等12个税目进口产品,中止适用《海峡两岸经济合作框架协议》协定税率,按现行有关规定执行。

资 讯

积聚“进”的力量——从中央经济工作会议听“潜力”

草肏网年末将至,多个领域的最新数据显示,中国经济持续恢复向好,“稳”的基础不断夯实,“进”的力量持续积聚。

资 讯

从中央经济工作会议听“动力”

用大鸡巴操美女小穴网站

拥有14亿多人口、世界上最大规模的中等收入群体,稳居世界第二大货物进口国,这是中国经济优势所在,也是在新征程上攻坚克难底气所在。

资 讯

台商投资大陆宣传推介活动在京举办

舔阴自拍视频

两岸关系和平发展是造福两岸同胞的光明之路,希望台胞台企共同推动两岸关系重回和平发展正确轨道。

资 讯

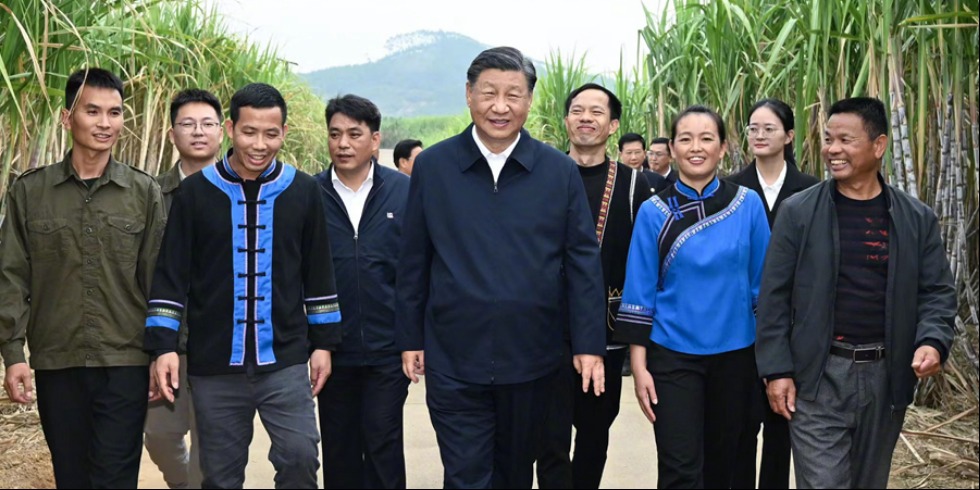

习近平在广西来宾市考察调研

色a草b14日下午,习近平在广西来宾市考察调研。他了解甘蔗良种繁育、种植收成、糖产业发展等情况。

资 讯

国台办:两岸“三通”为增进两岸同胞的共同利益发挥了重要作用

美女下部被操出水黄色视频两岸“三通”促进了两岸人流、物流、资金流,极大便利两岸民众往来,为增进两岸同胞的共同利益发挥了重要作用,广大台湾民众也从中受益。

资 讯

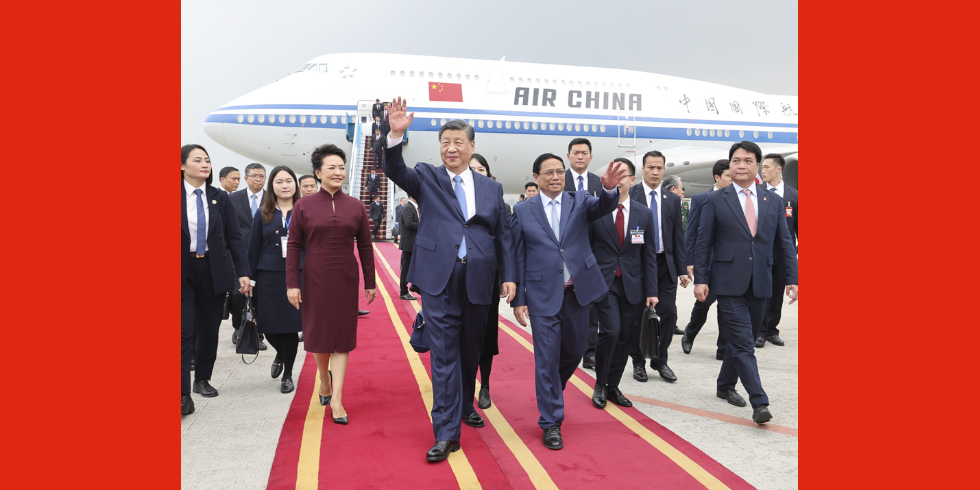

看一下美女跟男人操逼逼习近平同越共中央总书记阮富仲举行会谈

当地时间12月12日下午,刚刚抵达河内的中共中央总书记、国家主席习近平在越共中央驻地同越共中央总书记阮富仲举行会谈。

资 讯

2024年04月27日 我们不能忘不敢忘

86年过去,曾经的血与泪,从未忘记。今天是国家公祭日,祭奠同胞,铭记历史。愿逝者安息,愿吾辈自强!

资 讯

习近平抵达河内对越南进行国事访问

操小嫩屄视频网站当地时间12月12日中午,中共中央总书记、国家主席习近平乘专机抵达河内,对越南进行国事访问。

资 讯

2023余额仅剩5% 这些祝愿送给最好的你

2023余额已不足20天,或许今年的目标还差一点点。千万别放弃,你若奋斗定能有所收获。准备好,这些美好的祝愿送给你。